BACKGROUND

|

Overall, we have seen subdued activity within the Procurement and Vendor Management recruitment sector throughout 2024, slightly suppressing salary and interim rate increases through the year; with sector wage inflation largely mirroring overall UK wage inflation of 5.2% in 2024. (source: ONS)

2024 SUMMARY: After a nominal improvement in activity early last year, we saw a subdued and largely flat job market in Procurement, Vendor Management and Supply Chain disciplines, with moderate recruitment activity throughout the year, reflecting many clients’ cautious approach to staffing investment amid geopolitical and economic uncertainty. The hoped for improvement in economic and recruitment activity after the UK General Election and Autumn Budget were not evident; and we have witnessed a fairly lacklustre recruitment market extending to year end.

2025 PREDICTIONS: Demand for highly skilled Procurement, Vendor Management and Supply Chain people will remain strong, as awareness and focus on the contribution of high performing procurement functions, continue to point to an optimistic outlook for motivated and talented Procurement and Vendor Management Professionals in 2025. However, the economic and geopolitical landscape look to remain volatile, with the latest survey of Chief Financial Officers (CFO’s) indicate “firms cutting capex, discretionary spending and hiring over the next 12 months”, with the survey indicating the “sharpest fall in hiring expectations since the pandemic” (Source: Deloitte, 13th January 2025). The S&P Global Flash UK PMI figures for December, also indicate a marked pull-back in hiring (siting the Employer National Insurance contribution increases and new regulations around staffing) resulting in “employment falling in December, at the fastest rate since the global financial crisis in 2009 (if the pandemic is excluded).” On a more positive note, the latest economic predictions by KPMG, suggest that “UK GDP growth could rise to 1.7% in 2025 (well ahead of OECD forecast for 2024 of 0.9%), with” the large and frontloaded fiscal expansion announced in the UK Autumn Budget fuelling a temporary surge in domestic demand. A slow and cautious reduction in interest rates by the Bank of England is predicted to take the base interest rate to 4% by the end of 2025, higher than previously predicted, as higher costs are partially passed through to prices.” Critically for procurement professionals, the KPMG report ~ and mirrored by numerous other surveys ~ suggests that “trade frictions could lead to a more uneven outlook for global trade, with policy uncertainty, dampening global investment and bringing higher levels of financial market volatility.” (Source: S&P Global Flash UK PMI, 6th January 2025)

Procurement and Vendor Management salaries will continue to be driven up by demand and underlying wage rate inflation, and competition for suitably experienced and qualified Procurement and Vendor Management professionals will see some specialists secure significantly higher rates than is the sector norm. Rapid changes in technology and AI transformation, point to technologically savvy and flexible procurement and vendor management professionals being highly sought after, and opportunities for these people will be significant. Finding, attracting and securing this talent will remain the biggest challenge for many employers in the oncoming year.

Whatever the economic outlook, demand for highly skilled Procurement and Vendor Management people will remain strong, and ever-increasing awareness and focus on the contribution of high performing procurement functions in enhancing supply chain efficiency and reducing costs, continue to point to an optimistic outlook for talented and ambitious Procurement & Vendor Management Professionals in 2025.

|

.

|

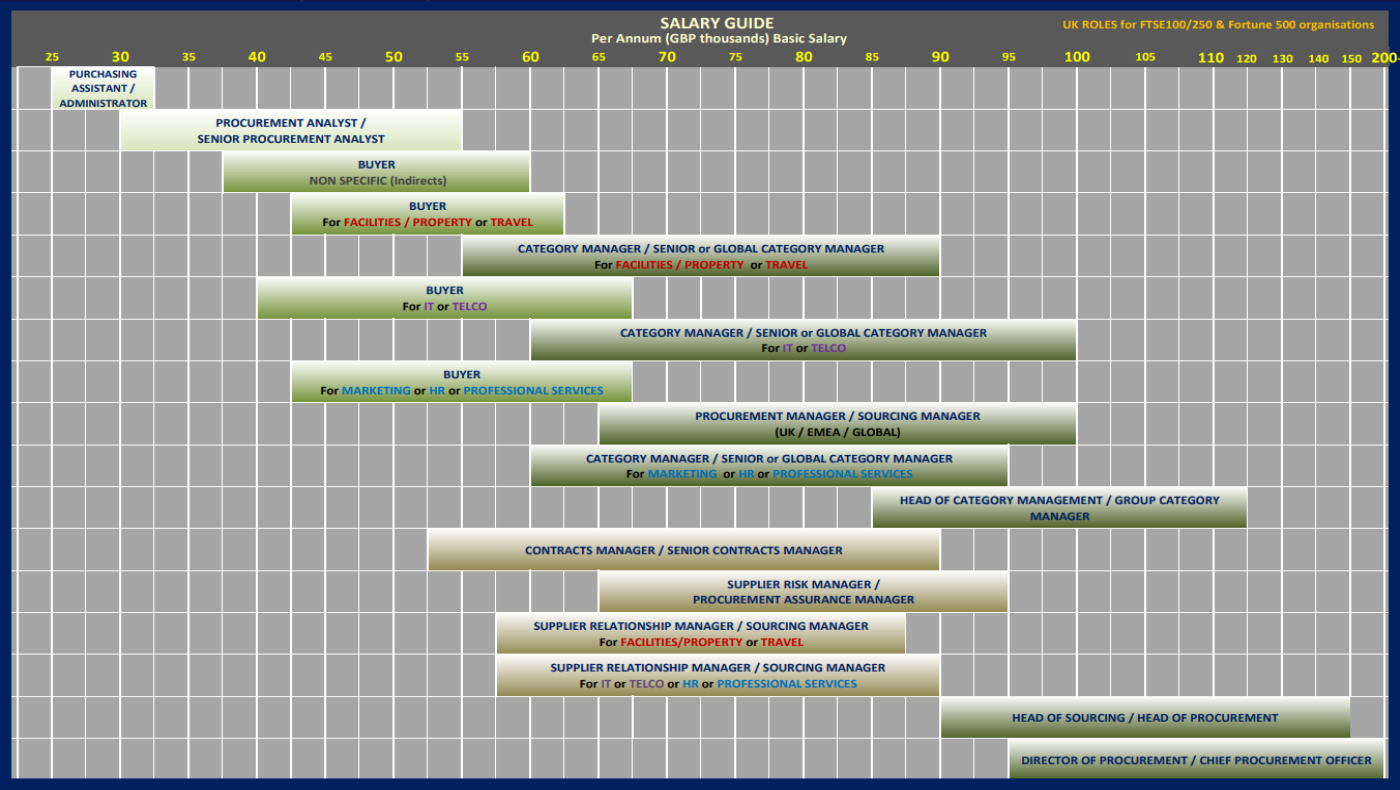

**** SALARY GUIDE - PROCUREMENT & VENDOR MANAGEMENT ****

|

The table provides Salary Ranges for various levels of Procurement & Supplier/Vendor Management specialists

~ focusing on ‘Indirect’ Specialists in FTSE100/250 & Fortune 500 organisations.

(Source: Beaumont Select Clients 2024 analysis & other market analysis)

|

|

SALARIES & PACKAGES BY SECTOR

There remains significant disparity in salaries and job packages across industry sectors; although there are plenty of exceptions as the race for talent has become more intense. Increased hybrid working options have helped reduce geographical differences slightly, but salaries offered, primarily reflect regional cost of living, housing availability, comparative regional employers salaries offered, and industry sector.

INVESTMENT BANKING / HEDGE FUNDS / FINANCIAL TECHNOLOGIES SECTORS:

- SALARIES are usually the highest than in any other sector.

- BONUSES in these sectors remain higher than the industry average and could be 30% or more at senior levels, usually based on a combination of individual and company performance. At Category Manager level, the total bonus potential is more likely to be at circa 10-20%, but this can vary significantly between organisations.

- COMPREHENSIVE BENEFITS PACKAGES are offered, although a company car is not usually included due to central London locations.

- Hybrid working is usually available, but many of these firms require employers to be in the office a minimum of 3 or 4 days a week.

- Main Locations: Almost all Central London

RETAIL BANKING / INSURANCE / OTHER FINANCIAL SERVICES SECTORS:

- SALARIES and PACKAGES/BONUSES fall a little way behind Investment Banking, Hedge Funds and FinTech.

- Bonuses are normally in the 10% to 25% range, but packages don’t usually include a car allowance.

- Hybrid working is available, but many of these FS firms require their employees to be in the office a minimum of 3 or 4 days a week.

- Main Locations: Mainly London, Manchester, M4 Corridor, Other

PHARMACEUTICAL SECTOR:

- SALARY, PACKAGES and BONUS are often very strong, although there is quite a variation across the sector. Pharma offers some of the best overall employment packages, with good and consistent bonus potential, share options as well as competitive pension and benefits. A company car or car allowance is usually included. Hybrid working options are usually good.

- There is the sense that the credibility and desirability of working in this sector has increased since pandemic; and this sector continues to attract and secure the very best talent.

- Main Locations: UK Wide

IT / TECHNOLOGY SECTORS:

- There is quite a wide variety of salary rates across the IT and Technology sector, however most packages come with car/car allowances and reasonable bonus potential and additional benefits. Big Tech Firms’ post pandemic layoffs slowed sector salary growth in 2022/23, but there are indicators that demand for new technologies and AI, will strengthen demand in 2024 and onwards.

- Main Locations: London, M4 Corridor and UK Wide

RETAIL SECTOR:

- Traditionally rates in this sector have not been as high as others, however retail organisations needed to change their business models to reflect trends to online shopping and restructuring their supply chains after pandemic and other geopolitical upheavals. We saw rates rising in 2023.

- With the retail supply chain model changing so fast, supply chain efficiency, security and corporate responsibility are key issues in this sector, with strong salaries & packages offered for professionals with these skills.

- Challenges in global supply chains has led to a demand for Technology and IT procurement professionals that can challenge traditional supply chain models and create innovative solutions to improve supplychain security, visibility, sustainability and reduce risk.

- Main Locations: UK Wide

MANUFACTURING / FMCG / AUTOMOTIVE SECTORS:

- SALARIES are usually below those in the Technology sector.

- BENEFITS PACKAGES are usually competitive, and a car allowance will typically be included, particularly for more senior roles.

- The unprecedented supply chain challenges during, and post pandemic, drove up demand for exceptional supply chain professionals to resolve UK and global supply chain component, raw materials and labour shortages. This sector was hard hit during and after the pandemic, but sector pay strengthened in 2023, and we have continued to see strong demand for procurement talent amongst some automotive manufacturers in 2024, despite stringent EU Electric Vehicle targets for manufacturers not equating to consumer demand.

- Main Locations: Midlands, UK Wide

ENERGY AND UTILITIES SECTORS:

- We have continued to see uplift in salaries with demand partly led by renewables sector growth.

- Traditionally salaries in this sector have not been quite so strong, but we are seeing rates improving to attract the level of talent needed.

- Good hybrid working options, pensions and benefits are the norm.

- Main Locations: UK Wide

NOT FOR PROFIT SECTOR:

- SALARIES & BENEFITS packages usually fall significantly below other sectors; however, we have seen a slight increase in salaries as many organisations recruit higher level procurement professionals with the aim of making the organisation more commercial.

- Addition of things like London weighting and additional market supplements to bring salaries up are more common, but salaries remain well below market rate.

-------------------------------------------------------------

SPECIALISTS AND CATEGORIES IN DEMAND

- DIGITAL TRANSFORMATION specialist demand will remain high, candidates who understand data analytics and emerging AI technologies, will be especially well placed to secure competitive salaries and packages. Candidates that combine strong digital experience with traditional procurement or SRM skills will be in strong demand. The pandemic accelerated many companies’ digital transformation plans, changing the working landscape enormously in a brief time. Rapid advancement in information technologies supporting effective supply chain management, driven by recent economic and geopolitical challenges, and the emerging influence of AI, are clearly shaping the categories and skills needed by procurement and vendor management professionals.

- INFORMATION TECHNOLOGIES: SAAS, Software, Cyber, Apps Development, Hardware, Datacentres, Infrastructure and Networks specialist category demand will remain high~ required across most sectors, but we have seen the greatest demand within FinTech, Utilities, Pharma and Logistics & Supply Chain organisations. Businesses are having to very rapidly change their work and supply chain models to ensure competitivity, and technical ‘hit the ground running’ procurement specialists across most Hardware and Software categories, are in strong demand.

- DIGITAL MARKETING specialists required across almost all sectors, although changing working and customer interfacing methods in Banking, Retail and Pharma sectors have seen the greatest demand. The Pandemic brought a rapid and unprecedented change in how business market, supply and buy, and the demand for people that can define and implement these new digital marketing systems has seen a significant increase in the demand for category specialists in this area.

- HR category specialists: Changing work pattern and the challenges of securing the best talent led to an urgent increase in demand for HR specialists in 2023, particularly within Managed Service Providers and Recruitment sectors.

- LOGISTICS category specialists. Ongoing geopolitical and economic instability continue to focus the necessity for effective and innovative logistic and supply chain strategies, which require talented logistics category and supplier specialists to support them.

- SUPPLIER RISK, SUPPLIER GOVERNANCE & SUSTAINABILITY specialists have been highly sought after, and we believe demand in these disciplines will continue to increase.Demand for Supplier Management specialist with solid Supplier Risk Management experience is very strong, and candidates with a relevant experience in Fraud, Quality, Compliance, Cost and Delivery strategy and implementation continue to be snapped up fast. Procurement and supplier management professionals with proven skills in de-carbonisation are also highly prized.

-------------------------------------------------------------

SUMMARY

|

In 2024 amid continuing geopolitical and economic uncertainty, employer survey data, and our experience suggested that many employers remained cautious towards both permanent and interim workforce investment. Balancing employers’ limited recruitment budgets with a ‘skills short’ recruitment market was the most significant recruitment challenge in 2024, with exceptionally slow recruitment processes, and some roles remaining unfilled. Whilst employers battled with their costs in a very challenging economic environment. Under this pressure, 2024 salaries and interim rates have not increased at quite the same rate as in 2023, where we saw permanent salaries for procurement and supplier management professionals increase slightly ahead of average wage inflation, but with some categories and disciplines showing a more pronounced increase, particularly mid-level Category Managers (HR, Marketing, Digital, IT and Professional Services) and Senior Global Category Lead levels (Technology, Professional Services & Legal Services).

Employers that need to attract the very best talent, should carefully consider their employer brand proposition; their on-boarding processes, and their salary and benefits packages (particularly hybrid working option) against other employers and their own and other sectors, to ensure they attract and secure the skills that they need.

Despite economic uncertainty, many Procurement & Vendor Management professionals see economic uncertainty less of a hindrance and more an opportunity, where most wish to develop their skill sets and talents in an environment where their specialist experience and skills are truly recognised and rewarded. Where organisations do not support these ambitions, these high contributing professionals with significant employment options, are not afraid to see ‘what else is out there’ and will look for new opportunities that meet with their financial, ethical and life goals.

|

-------------------------------------------------------------

If you would like more information about Permanent or Interim Recruitment Solutions for Procurement, Supply Chain and Vendor Management disciplines, please call:

T: +44 (0)1403 248 448

E: info@beselect.co.uk

|

The Beaumont Select Recruitment Team

Beaumont Select Market Bulletin, January 2025

|